Are you a farmer who’s interested in the ERP-2 program, but you’re not sure how to apply?

Read this, we’ll walk you through it.

Here at NSI, we understand how intimidating it can be to go down to the FSA Office to apply, but it doesn’t have to be a difficult process.

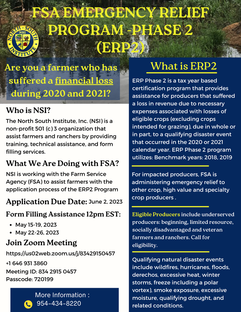

The ERP-2 is a tax-year-based certification program that provides assistance for producers who suffered a loss in revenue due to necessary expenses associated with losses of eligible crops due to disaster events that occurred in 2020 or 2021.

Here’s what you need in order to apply:

➡️ Supporting documentation used to create IRS Schedule F

➡️ Profit or Loss from Farming

➡️ A copy of the FSA-1099G for the selected benchmark and disaster years

(You can use your 2018/2019 taxes as the benchmark year(s) and use 2020/2021 taxes as the disaster years).

You have until June 2, 2023 to apply.

Wish someone could walk you through the process? Send us a message and we’ll be there to help every step of the way.

Read this, we’ll walk you through it.

Here at NSI, we understand how intimidating it can be to go down to the FSA Office to apply, but it doesn’t have to be a difficult process.

The ERP-2 is a tax-year-based certification program that provides assistance for producers who suffered a loss in revenue due to necessary expenses associated with losses of eligible crops due to disaster events that occurred in 2020 or 2021.

Here’s what you need in order to apply:

➡️ Supporting documentation used to create IRS Schedule F

➡️ Profit or Loss from Farming

➡️ A copy of the FSA-1099G for the selected benchmark and disaster years

(You can use your 2018/2019 taxes as the benchmark year(s) and use 2020/2021 taxes as the disaster years).

You have until June 2, 2023 to apply.

Wish someone could walk you through the process? Send us a message and we’ll be there to help every step of the way.

RSS Feed

RSS Feed