Past Workshops

Renewable energy solar power workshop April 2018

Learn from the experts how to:

*Install a solar power energy system

*Improve energy management on a small farm

*Power your farm and improve efficiency

*Power your home or business after a hurricane

*And more…

Who should attend this workshop:

Farmers, homeowners, business owners, property managers, builders

Florida Family Farm conference July 2017

July 17th - 18th, 2017

Title of Workshop: Florida Family Farm Conference

- Soil & Water Management Part I & II

- Energy Management on Small Farms Part I & II

- Growing Specialty Crops that gives High Yield per Acre

- Control of Major Pests and Diseases and Introduction to Organic Farming for Selected Crops

- USDA Panel Discussion Part II: USDA Programs for Farmers:

- USDA Outreach Clinic: Understanding and using USDA Programs; Form Filling, Program One-on One Session/s and Farmers Exploring the USDA Program Landscape with Program Specialist.

- Farmers One-on-One Farm Demonstration: How to Plant and Cut Specific Specialty Crops, Pest Control, and Applicators License

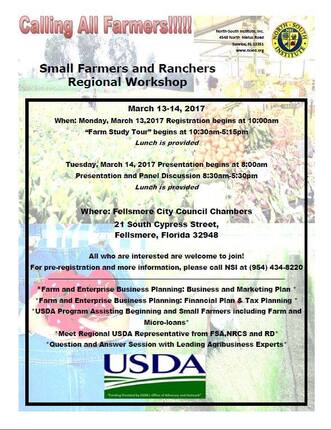

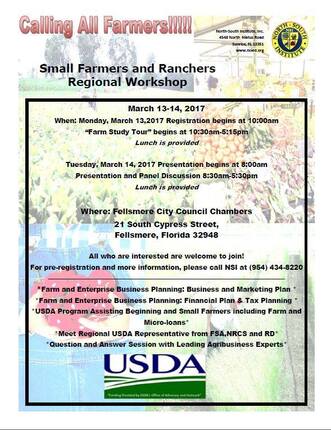

Small Farmer and ranchers regional workshop day 1 March 2017

March 13, 2017 Day 1

Title of Workshop: Complete 25 Business and Marketing Plan I: Small Farmers and Ranchers Regional Workshop

Farm Field Visit and Risk Management:

Livestock, Irrigation System and Solar Station for Farm/

11:00am - 12:30pm- Brevard Beef Cattle and Orange Orchid,

1:30pm - 3:15pm Ithuba Shrimp Farm, and

3:30pm - 5:00pm- Seven Oaks Farm(quail and Goats, Weaver's Way Farm (Chicken and Miniature Cows), and Burge's Family Farm (Chicken, Duck, and Cattle)

Title of Workshop: Complete 25 Business and Marketing Plan I: Small Farmers and Ranchers Regional Workshop

Farm Field Visit and Risk Management:

Livestock, Irrigation System and Solar Station for Farm/

11:00am - 12:30pm- Brevard Beef Cattle and Orange Orchid,

1:30pm - 3:15pm Ithuba Shrimp Farm, and

3:30pm - 5:00pm- Seven Oaks Farm(quail and Goats, Weaver's Way Farm (Chicken and Miniature Cows), and Burge's Family Farm (Chicken, Duck, and Cattle)

small farmer and ranchers regional workshop day 2 March 2017

March 14, 2017 Day 2

Title of Workshop: Complete 25 Business and Marketing Plan II: Small Farmers and Ranchers Regional Workshop:

Farm and Enterprise Business Planning: Business and Marketing Plan-

Dr. Lamie and Mr. Green (8:30am-12:30pm)

Farm and Enterprise Business Planning: Financial Plan & Tax Planning-

Dr. Thomas McConnell (1:30pm- 2:30pm)

Panel discussion with UDSA/Agency ( Natural Resource Conservation Services(NRCS), Rural Development (RD), Farm Service Agency (FSA) - Jennifer Brown FSA, Loan Officer, Howard Harrison, NRCS, District Conservationist, Catrina Southall, RD, Area Director, Latasha Thomas-Pace, RD, Officer (2:30pm - 5:00pm)

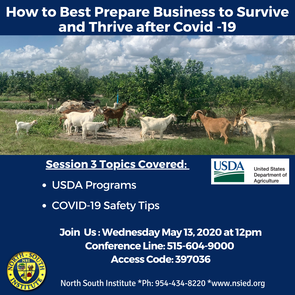

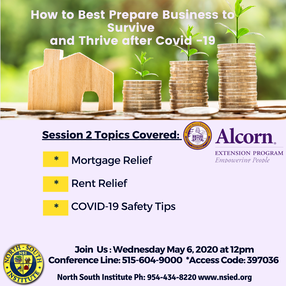

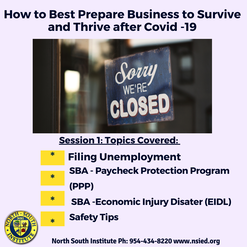

Past Webinars 2020

COVID-19 Webinar Workshop

TAKE STEPS NOW TO PREPARE FOR CORONAVIRUS ASSISTANCE- USDA

In April, USDA announced the Coronavirus Food Assistance Program (CFAP). CFAP will provide direct support based on losses for agriculture producers where prices and market supply chains have been significantly impacted and will assist eligible producers facing additional adjustment and marketing costs resulting from lost demand and short-term oversupply for the 2020 marketing year caused by COVID-19.

CFAP will provide assistance to most farms that have experienced at least a five percent loss and will be available to farms regardless of size. We are still working on the final details of the actual payment rates and those details will be determined and included as part of the rulemaking process. Once the rule making process is complete, the application period will be open and subject to the eligibility and payment limit criteria described in the rule.

As part of applying for the program, you’ll need to contact the Farm Service Agency county office to schedule an appointment. Your local FSA staff will work with you to apply for the program, and through forms asking for this type of information:

If you are an existing customer, this information is likely on file at your local Service Center.

What Can You Do Now?

While the application process has not started, you can start gathering/understanding your farm’s recent sales and inventory.

FSA has streamlined the signup process to not require an acreage report at the time of application and a USDA farm number may not be immediately needed.

How Will USDA Accept Applications?

USDA Service Centers are open for business by phone appointment only. Once the application period opens, please call your FSA county office to schedule an appointment.

Our staff is working with our agricultural producers by phone and using email, fax, mail, and online tools like Box to accept applications.

Information on CFAP can be found at farmers.gov/CFAP.

Questions?

Please contact your local FSA Office.

CFAP will provide assistance to most farms that have experienced at least a five percent loss and will be available to farms regardless of size. We are still working on the final details of the actual payment rates and those details will be determined and included as part of the rulemaking process. Once the rule making process is complete, the application period will be open and subject to the eligibility and payment limit criteria described in the rule.

As part of applying for the program, you’ll need to contact the Farm Service Agency county office to schedule an appointment. Your local FSA staff will work with you to apply for the program, and through forms asking for this type of information:

- Contact

- Personal, including your Tax Identification Number

- Farming operating structure

- Adjusted Gross Income to ensure eligibility

- Direct deposit to enable payment

If you are an existing customer, this information is likely on file at your local Service Center.

What Can You Do Now?

While the application process has not started, you can start gathering/understanding your farm’s recent sales and inventory.

FSA has streamlined the signup process to not require an acreage report at the time of application and a USDA farm number may not be immediately needed.

How Will USDA Accept Applications?

USDA Service Centers are open for business by phone appointment only. Once the application period opens, please call your FSA county office to schedule an appointment.

Our staff is working with our agricultural producers by phone and using email, fax, mail, and online tools like Box to accept applications.

Information on CFAP can be found at farmers.gov/CFAP.

Questions?

Please contact your local FSA Office.

PAYCHECK PROTECTION PROGRAM (PPP) & ECONOMIC INJURY DISASTER LOAN (EIDL)

Paycheck Protection Program (PPP)

If you hire W-2 employees, you may want to look at both PPP and EIDL.

Look at EIDL if you do not hire W-2 employees.

Businesses cannot include their 1099 workers in their payroll calculations.

If an individual receives a 1099 from a business, they can apply for PPP as a 1099 earner.

Details about the Paycheck Protection Program (PPP)

Don’t wait. The time is now. The banks are expecting this money to run out by Friday.

It is 100% forgivable if you follow the rules… (1) using 75% of the loan for payroll expenses and 25% of the loan proceeds to pay rent, utilities and related fees due before February; (2) You must keep employees on the payroll for the next 8 weeks after receiving the PPP. The PPP requires that you use the funds for the immediate 8 weeks going forward from when you receive the loan in your account.

It’s a 2-year loan at 2% interest. On the promissory note, you will see that it will show your repayment over 18 months, because the US government covers the first 6 months. Use the money correctly over the first 6 months, document what you do with the money, and then apply for the loan forgiveness to avoid having to pay back the loan.

There is good info in the treasury’s website http://treasury.gov/cares to calculate payroll costs.

If you operate more than one business, you can apply for separate PPP loans for each business. You can only apply for and receive PPP funds once (per business) and the funds have to be exhausted by June 30th.

To get your application in quickly:

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

Where to find the PPP application form and the application process

Small Business Administration PPP - Borrower Application

The PPP loan application is online - SBA Form 2483. Use this link to get the form:

https://www.sba.gov/sites/default/files/2020-04/PPP-Borrower-Application-Form-Fillable.pdf

You can apply through any existing SBA 7(a) lender or through any participating federally insured depository institution, federally insured credit union, and Farm Credit System institution.

Strategic select who you submit your application with. You want to increase your chances by using the state banks, regional, and local banks. Just because you have your money with a big bank does not mean that that location is where you should go.

If you have applied for PPP with a lender, but are not able to get through – not responsive, you can write them an email to withdraw your application there and apply with another lender.

You can get an approved agent to help you complete the application. The bank pays the agent depending on the approved loan amount based on a schedule. If an agent states that the applicant has to pay them, find another agent. There are no application fees and the bank/lender pays the agent directly.

Items Needed to Apply:

National Development Council (NDC) training video link to complete the PPP Application

(You will need to register with your email to view the training video): https://www.gotostage.com/channel/710f557595d6405885452290c5df91c7/recording/72e65e3a2f9f40829d9860c5a4a80ec7/watch

Tax returns are the biggest issue. Workarounds include using your 2018 Profit & Loss Statements from your tax accountant. Do not misappropriate your amounts. No personal guarantee or collateral required for PPP.

General PPP Tips

Read the source documents. One mistake seen is that a lot of people are not including the health benefits, pension, and other benefits provided to employees.

Use the Gross cost of your payroll, not the Net. Make sure you explain in the email with your application where the calculations came from. The 0.5 of the 2.5 multiple is intended to be used for the rent/ lease, utilities, water, etc. (not the car payment).

You may wish to establish a separate account to handle and track your payroll separately.

Check out the treasury website and strategize the plan to apply for the funds.

Economic Injury Disaster Loan (EIDL)

Details about the Economic Injury Disaster Loan (EIDL)

When the PPP Funds are gone, SBA will still have their Economic Injury Disaster Loan (EIDL) in place. The CARES act put money into the disaster loan (EIDL) and SBA is hoping to open EIDL to start receiving applications again this week.

SBA Economic Injury Disaster Loan Details

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loan-emergency-advance

Personal Guarantee required for 20% or more ownership for EIDL.

Click the associated box on the application to be considered for the $10,000 loan advance.

If you hire W-2 employees, you may want to look at both PPP and EIDL.

Look at EIDL if you do not hire W-2 employees.

Businesses cannot include their 1099 workers in their payroll calculations.

If an individual receives a 1099 from a business, they can apply for PPP as a 1099 earner.

Details about the Paycheck Protection Program (PPP)

Don’t wait. The time is now. The banks are expecting this money to run out by Friday.

It is 100% forgivable if you follow the rules… (1) using 75% of the loan for payroll expenses and 25% of the loan proceeds to pay rent, utilities and related fees due before February; (2) You must keep employees on the payroll for the next 8 weeks after receiving the PPP. The PPP requires that you use the funds for the immediate 8 weeks going forward from when you receive the loan in your account.

It’s a 2-year loan at 2% interest. On the promissory note, you will see that it will show your repayment over 18 months, because the US government covers the first 6 months. Use the money correctly over the first 6 months, document what you do with the money, and then apply for the loan forgiveness to avoid having to pay back the loan.

There is good info in the treasury’s website http://treasury.gov/cares to calculate payroll costs.

If you operate more than one business, you can apply for separate PPP loans for each business. You can only apply for and receive PPP funds once (per business) and the funds have to be exhausted by June 30th.

To get your application in quickly:

- Prepare your documents before you call you bank. They use payroll tax documents, QuickBooks payroll summary, or tax documents. Write down where you got your numbers from and be able to explain it quickly. The more prepared you are, the faster the processor can go through your file and enter you into a system.

- Carefully read and prepare the 2-page application. Confirm that you live in the U.S.

- Think about the forgiveness part of the loan in the beginning. Just because you qualify for $30,000 doesn’t mean that you should apply for that amount. It’s only forgivable if you use the money per the rules. Otherwise, you will have to pay it back. Plan how you will use these funds.

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

Where to find the PPP application form and the application process

Small Business Administration PPP - Borrower Application

The PPP loan application is online - SBA Form 2483. Use this link to get the form:

https://www.sba.gov/sites/default/files/2020-04/PPP-Borrower-Application-Form-Fillable.pdf

You can apply through any existing SBA 7(a) lender or through any participating federally insured depository institution, federally insured credit union, and Farm Credit System institution.

Strategic select who you submit your application with. You want to increase your chances by using the state banks, regional, and local banks. Just because you have your money with a big bank does not mean that that location is where you should go.

If you have applied for PPP with a lender, but are not able to get through – not responsive, you can write them an email to withdraw your application there and apply with another lender.

You can get an approved agent to help you complete the application. The bank pays the agent depending on the approved loan amount based on a schedule. If an agent states that the applicant has to pay them, find another agent. There are no application fees and the bank/lender pays the agent directly.

Items Needed to Apply:

National Development Council (NDC) training video link to complete the PPP Application

(You will need to register with your email to view the training video): https://www.gotostage.com/channel/710f557595d6405885452290c5df91c7/recording/72e65e3a2f9f40829d9860c5a4a80ec7/watch

Tax returns are the biggest issue. Workarounds include using your 2018 Profit & Loss Statements from your tax accountant. Do not misappropriate your amounts. No personal guarantee or collateral required for PPP.

- Payroll expenses (from QuickBooks or Accountant)

- Humana Health and Dental Monthly Payments (show how your averages are calculated)

- 941 Forms (Quarterly tax statements) and 940 Forms (Annual tax statements)

- 2018 and 2019 Profit & Loss Statements

- 2018 and 2019 tax returns

- Driver’s License

- Properly calculated totals

General PPP Tips

Read the source documents. One mistake seen is that a lot of people are not including the health benefits, pension, and other benefits provided to employees.

Use the Gross cost of your payroll, not the Net. Make sure you explain in the email with your application where the calculations came from. The 0.5 of the 2.5 multiple is intended to be used for the rent/ lease, utilities, water, etc. (not the car payment).

You may wish to establish a separate account to handle and track your payroll separately.

Check out the treasury website and strategize the plan to apply for the funds.

Economic Injury Disaster Loan (EIDL)

Details about the Economic Injury Disaster Loan (EIDL)

When the PPP Funds are gone, SBA will still have their Economic Injury Disaster Loan (EIDL) in place. The CARES act put money into the disaster loan (EIDL) and SBA is hoping to open EIDL to start receiving applications again this week.

SBA Economic Injury Disaster Loan Details

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loan-emergency-advance

Personal Guarantee required for 20% or more ownership for EIDL.

Click the associated box on the application to be considered for the $10,000 loan advance.

2019 Webinars

- March 19, 2019 - Agri-tourism – A new path for today’s agriculture farmers market, roadside market and on farm farmers market with farm tours part 2

- March 12, 2019 - Agri-tourism – a new path for today’s agriculture farmers market, roadside market and on farm farmers market with farm tours part 1

- February 19, 2019 - Development of local direct food marketing network/direct marketing

- February 12, 2019 - Development of local direct food marketing network/direct marketing

- February 5, 2019 - Developing and using an effective marketing plan part 2

- January 29, 2019 - Developing and using an effective marketing plan part 1

- January 22, 2019 - Getting the basics first (farm registration and creating farm records with USDA)

2018 Webinars

- MAY 22, 2018 Successful Marketing Strategies for Beginning Farmers and Ranchers on Small and Medium size Farmers/USDA Disaster Assistance Programs

- MARCH 19, 2018 Protect Your Farm with Risk Management Tools!!

- MARCH 12, 2018 Organize Your Records with Farm Record Keeping

- FEBRUARY 27, 2018 Business and Marketing Plan-Review

2017 webinars

- MARCH 27, 2017 Financial Planning and Farm Tax Part II

- MAY 15, 2017 Business and Marketing Plan-Review

- FEBRUARY 22, 2017 UDSA program Summary

- FEBRUARY 21, 2017 FSA Programs: NAP, Farm Loan, Microloan

- JANUARY 24, 2017 NRCS Programs

- JANUARY 23, 2017 What all Beginning Farmers need to know? Part III

- JANUARY 10, 2017 What all Beginning Farmers need to know? Part II

- JANUARY 9, 2017 What all Beginning Farmers need to know? Part I